The Retirement Plan That Grows To Support Your CPF Life

Earn a fulfilled retirement in Singapore, for real.

Retirement plan that tracks S&P500 performance

Investment that provides protection as well

Capital protection upon bequest

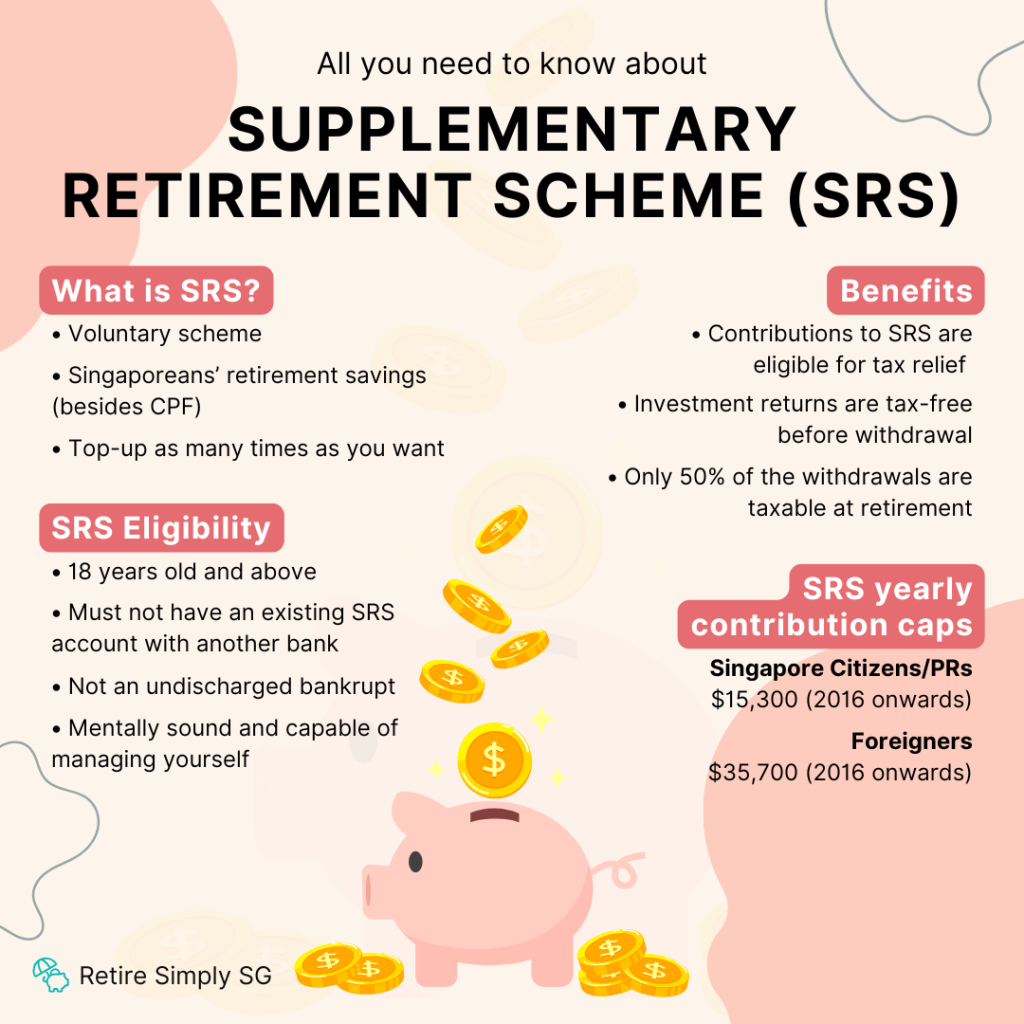

TIP: Option to invest with SRS monies for tax-free returns

Why Trust Us?

Independent financial advisors with transparent & unbiased recommendations

Capital placed only with reputable insurers in the region

Quick, hassle-free policy signing

Retire fulfilled by building a retirement plan that adapts to your life stages, tracking global indices and/or investing in equities. Capital protection upon bequest and additional protection component for peace of mind.

How it works

After a prompt yet comprehensive assessment and review by our certified and licensed retirement advisors, we will get several options based on your life stage, risk appetite, family situation and other factors. Our retirement advisor will then advise on the most suitable action plan for you to earn a fulfilled retirement.

Prompt yet comprehensive assessment and review by our certified and licensed retirement advisors

Several options based on your life stage, risk appetite, family situation and other factors

Select the most suitable action plan for you to earn a fulfilled retirement with our advisor’s help

Why do I need a retirement plan when I have CPF LIFE?

Comfortable retirement is not cheap.

In a recent study by OCBC Bank, 34% of people in their 20s and 28% of those in their 30s were aiming for a retirement lifestyle that will cost almost $6,000 a month!

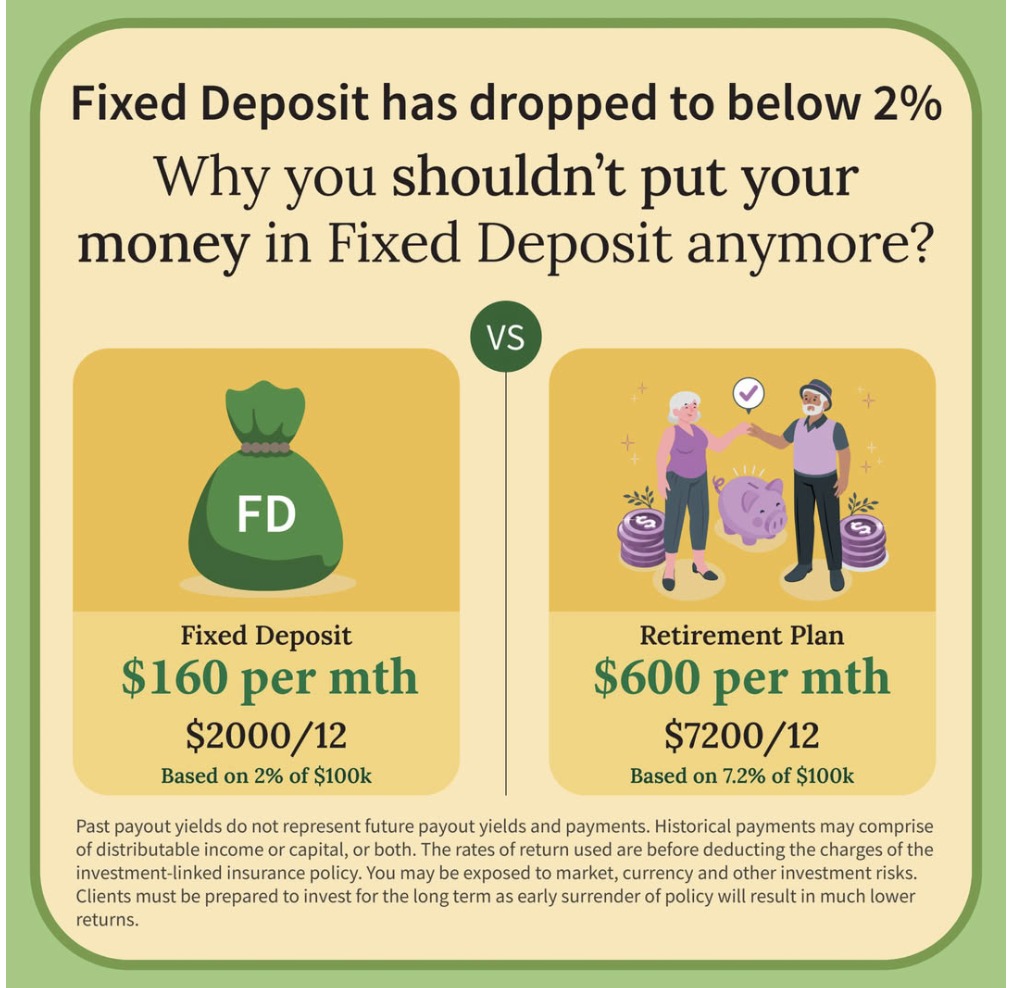

A simple and basic lifestyle for current retirees will cost at least S$2,500 a month to maintain. For someone aged 40 now, hoping to retire at the age of 65, with a rough inflation rate of 3%, it would take about S$4,000 a month in the future to have a basic retirement lifestyle.

Therefore, relying on CPF LIFE payouts alone is most likely insufficient to cover all your basic retirement expenses, let alone a comfortable retirement lifestyle.

While CPF LIFE is a valuable part of your retirement income, it is also important to consider other sources of income to ensure that you have enough for your retirement.

Finding the best retirement plan for your situation

Each plan has its own unique features and benefits, as they cater to different needs. That said, the goal of achieving financial stability in your golden years remains the same. CPF LIFE holds up well as a basic annuity plan, while a private retirement plan fills any potential gaps.

We are a team of authorised independent financial advisors (IFAs) from Promiseland Financial Advisory Pte Ltd, and we represent almost all of the insurers and investment platforms. That’s why our clients engage us to compare and recommend the best retirement plan based on their specific needs and requirements.

We specialise in CPF calculation and plan your retirement professionally. Please leave your contact details and we will get in touch within 1 business day (usually within the day).

Your choice, your terms: lump sum or lifetime monthly payouts

Flexibility is key when you retire. You get to choose a lump sum payout upon maturity, or lifetime monthly payouts. For lump sum payout, we get to withdraw the entire portfolio – PLUS our compounded earnings.

We recommend clients to get lifetime monthly payouts instead, though, since as long as our retirement portfolio has money, it continues earning (like our CPF LIFE).

Another option is to withdraw a smaller lump sum and leave the minimum amount in the retirement fund to let it continue compounding while you get lifetime monthly payouts.

Also, when you pass on, your retirement portfolio is protected and can be left as part of your estate to your loved ones.

Your Retirement Advisor, Lexi Toh

Promiseland Financial Advisory Pte Ltd

Secure a fulfilled retirement in Singapore with Lexi. She works closely with families to develop financial strategies that not only provide for today but also ensure long-term financial well-being. Lexi helps you build a retirement plan that supports your desired lifestyle for years to come.

Carol

Lexi excels as an insurance agent with her swift responsiveness, demonstrating a deep understanding of the insurance field. She prioritize client satisfaction and convenience, offering solutions that best match my personal situations. Her professionalism and commitment to clients' best interests make her highly commendable for anyone seeking reliable insurance guidance.

Doreen - Retiree

Lexi is diligent, prompt and can be trusted to get us properly insured everytime. This allows us to sleep soundly knowing that we are well protected. She is knowledgeable, patient and also provides us with a helpful attitude. A very personable individual, she takes good care of us especially in collating all our documentations. We really appreciate in having such an FA like her indeed. Lexi is certainly a great asset to us and I believe she is an invaluable asset to her company too!

Julie - Sr Manager

Lexi is a great person. She had helped me to organise all my policies and identify areas where I fell short. As such, I am able to achieve financial freedom well into retirement.

The Retirement Plan That Grows To Support Your CPF Life

Retirement plan that tracks S&P500 performance

Investment that provides protection as well

Capital protection upon bequest

TIP: Option to invest with SRS monies for tax-free returns